capabilities

Financial Trading Software for the Full Order Lifecycle and Beyond

Software Capabilities

Our multi-asset POEMS platform supports every step of the order lifecycle for hedge funds, asset managers and sell-side firms alike, and in markets around the globe.

Order Management

Create multiple views of the order blotter with custom columns and real-time calculations

Leverage bespoke allocation schemes and defaults that automatically mark swap versus cash accounts

Customize hotkeys for position sizing, quick entry to a chosen algo strategy and more

Link orders and separate prints for allocation based on time priority and order size

Leverage powerful stock locate capabilities

Utilize dynamic portfolio rebalancing/modeling tools

Integrate seamlessly with prime brokerage and clearing firms

Automate critical operations via LiquidityBook’s advanced API protocols, in addition to support for FIX drop copies

Ensure compliance at every stage of the trade lifecycle—from pre-trade checks to post-trade oversight

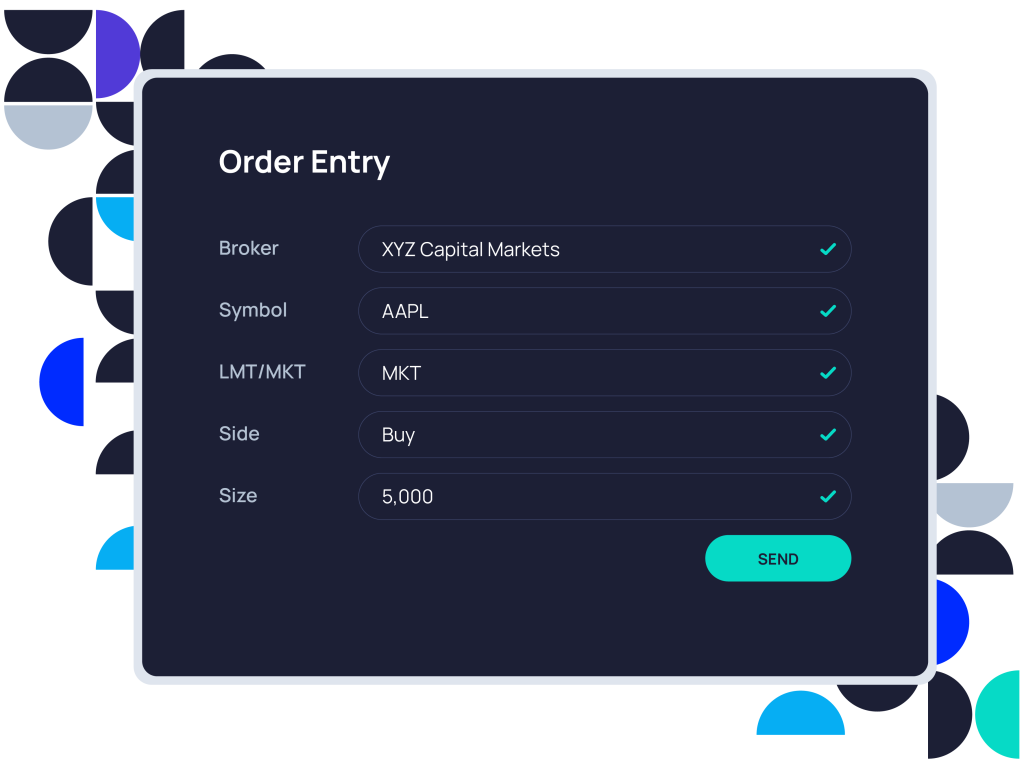

Execution Management

Achieve seamless API integration with key data providers

Enter orders through a variety of means, including IM (SMS, Symphony, Microsoft Teams, email and more)

Create custom alerts to stay up to date and fuel productivity

Access expanded multi-asset class capabilities

Route to over 1,600 destinations in over 80 supported markets around the globe

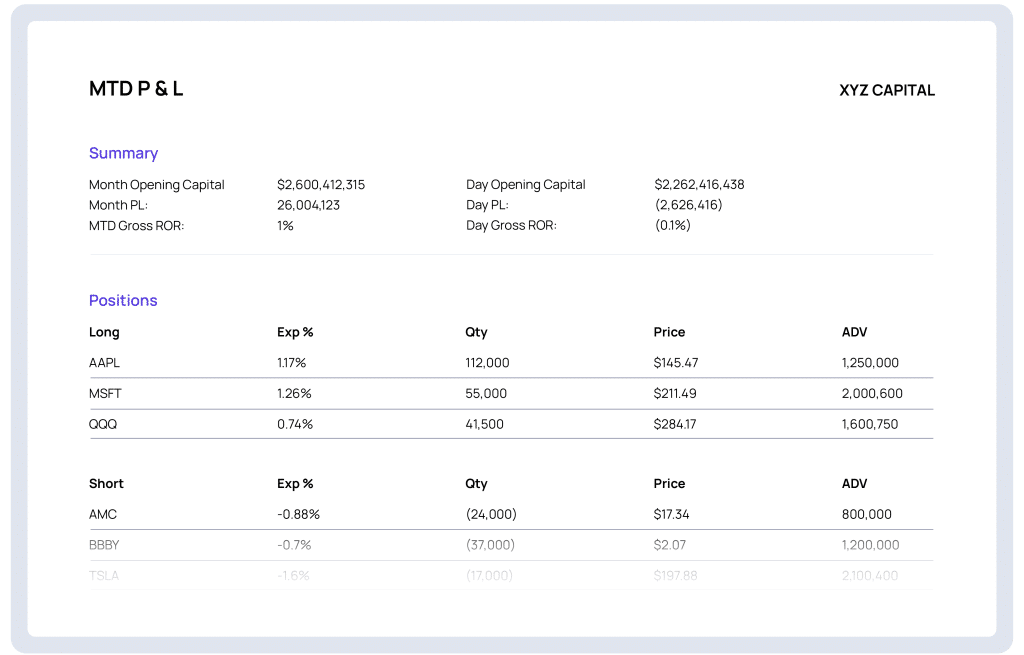

Portfolio Management

Access real-time and historical P&L

Employ multi-asset and multi-prime workflows

Rebalance by any metric, including exposure, basis points and notional dollar value

Revise weights based on multiple metrics and create custom models and model groupings

Leverage an open workbench to perform functions on the fly

Perform position, trade and multi-counterparty reconciliation

Adjust to market conditions quickly via real-time exposure and concentration tracking

Calculate shadow NAV to fulfill reporting obligations

Track accruals and run cash management functions

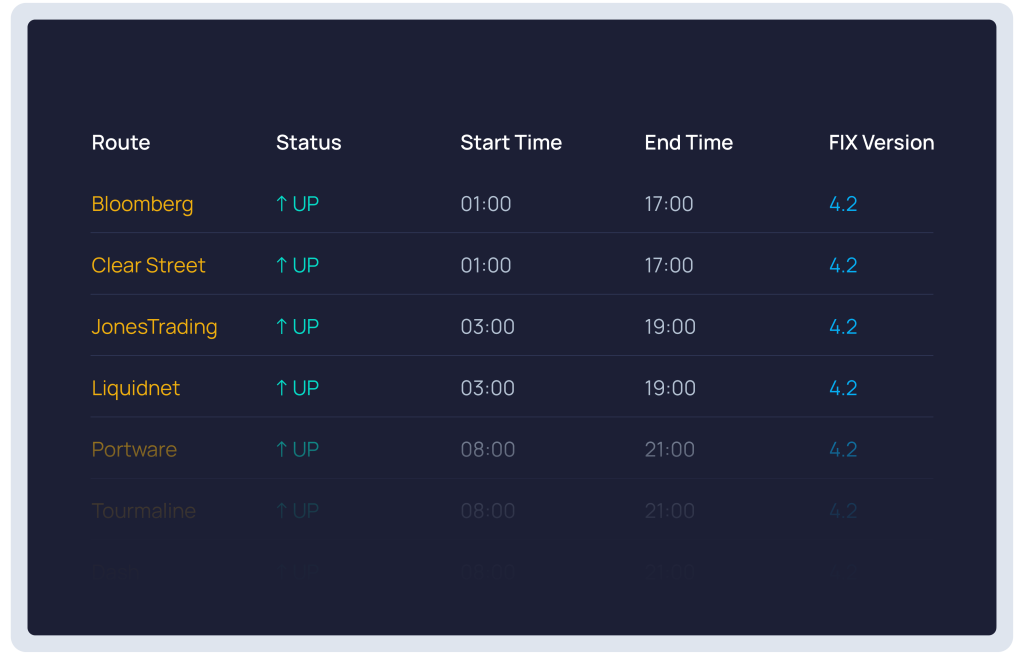

FIX Connectivity

Connect to over 250 FIX routing destinations in over 80 markets around the globe, encompassing equities, options, futures, fixed income and swaps trading

Leverage robust normalization logic to support different versions of FIX, different messages, split messages and more

Gain single sign-on access to a single connection to address all your trading needs, as well as a full suite of other services

Benefit from transparent pricing and full cost breakdowns –

no markups or added transactional costs

Trade Processing & Settlement

Post-Trade Processing

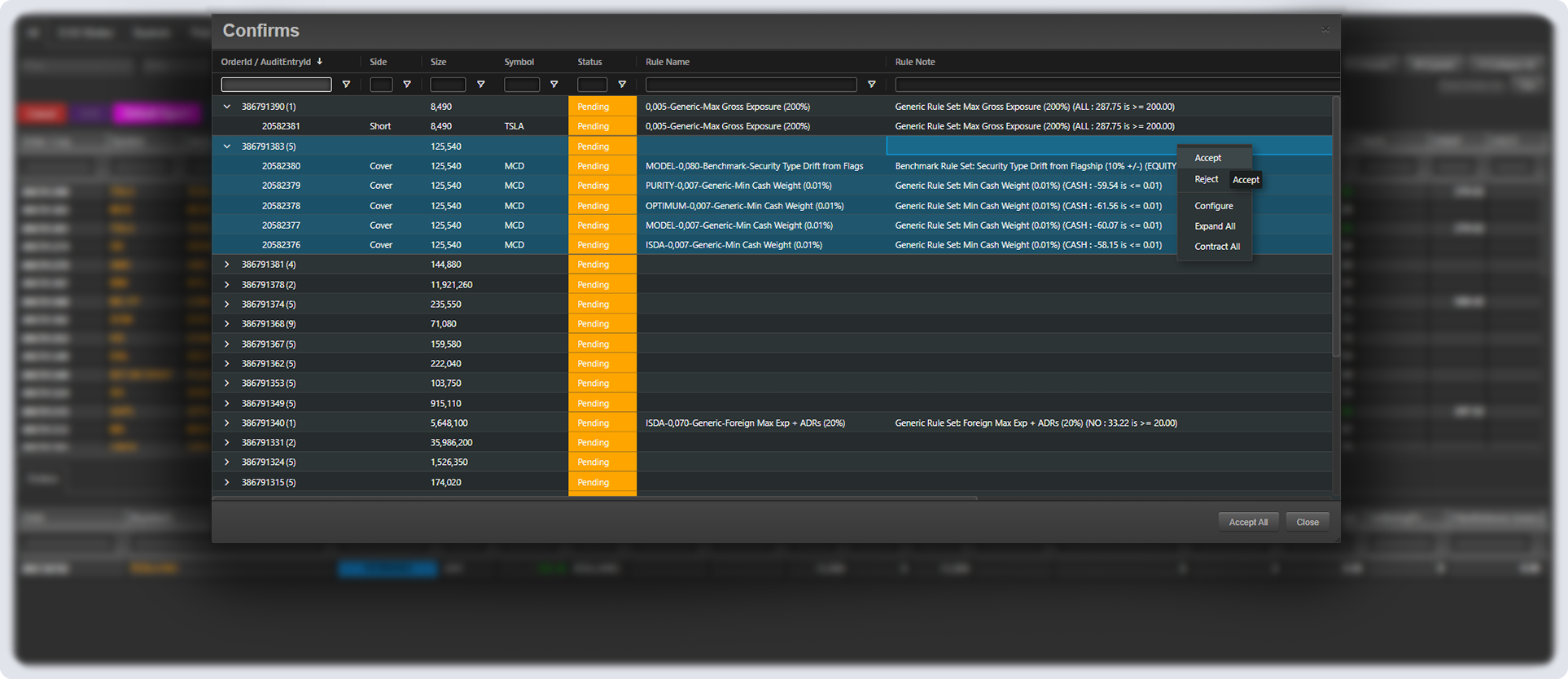

Reduce and rectify errors through enhanced visibility into post-trade processes while affirming matched confirmations and rejecting mismatched confirmations on either a manual or automated basis

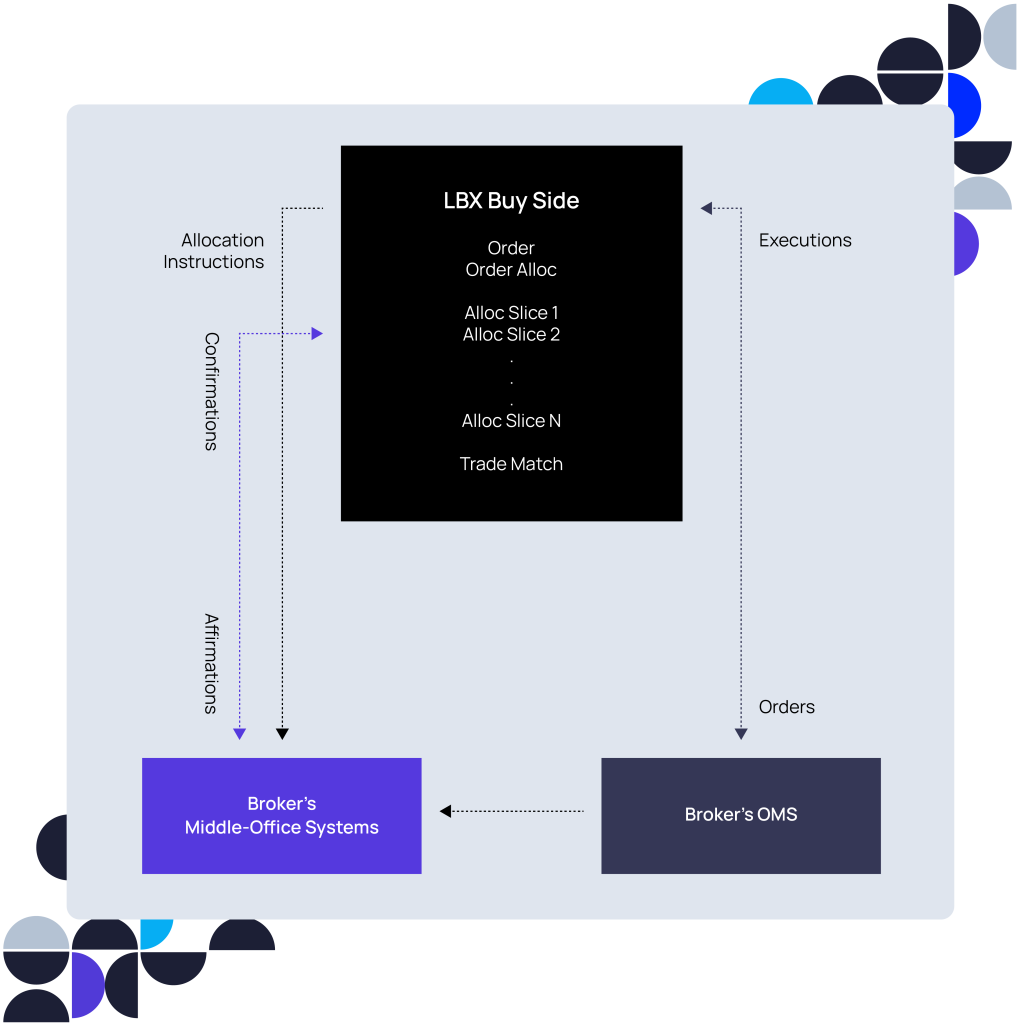

Seamlessly send FIX allocation instructions to broker-dealer counterparties – including multiple broker-specific allocation instructions for orders staged with more than one broker – leveraging the full power of LiquidityBook’s proprietary managed FIX network

Customize confirmation matching rules – including for trade date, side, quantity, security ID, account, settlement date and more – to achieve seamless third-party data transfer and reconciliation with all leading clearing firms, custodians, prime brokers and fund administrators

Leverage a robust trade matching engine and speak to a single counterparty if there are reconciliation issues and to allocate and affirm trades, all via FIX

Integrate with middle- and back-office functions like accounting, compliance, data warehouse, risk and 100’s of other third party applications

Pre- & Post-Trade Compliance

Pre-Trade Risk Management

Compliance Reporting

Customize rules based on ownership thresholds, exposure, custom calculations and more

Multiple levels of alert restrictions for both buy-side (40 Act, UCITS, etc.) and sell-side users (CAT, TRF, Rule 605/606, etc.)

Set up one- or two-person approval processes with group alerting and approvals via email, chat and GUI

Access an extensive post-trade reporting library and back-office integration- rule breaches historically, by category, level or user

Streamline operations with other key features including: options analytics; fund- and strategy-level VaR; margin exposure and monitoring; and valuation, performance, transaction and risk reports

API Integration

Seamlessly integrate a full range of functions across the front and middle offices, from synchronizing security master and account data to accessing fine-tuned trading capabilities

Eliminate redundancy, cost and correctness errors that stem from managing multiple independent silos

Manage our platform and tools in your own internal system, integrating with proprietary or third-party systems at the precise levels required

Benefit from scalable AWS servers than can handle any workflow bandwidth