Solutions/ LBX RIA

Comprehensive Order, Execution and Portfolio Management for the Modern RIA

The RIA space is experiencing unprecedented momentum – but many advisors still rely on outdated systems or manual processes that hamper efficiency and scalability, limiting their growth. As client expectations evolve, RIAs need technology that enables them to operate at an institutional level, without adding unnecessary overhead.

Enter LBX RIA – a fully cloud-based POEMS and model management solution designed for flexibility, automation and seamless integration with custodians. We empower RIAs to optimize their workflows, automate portfolio rebalancing and scale their business with confidence.

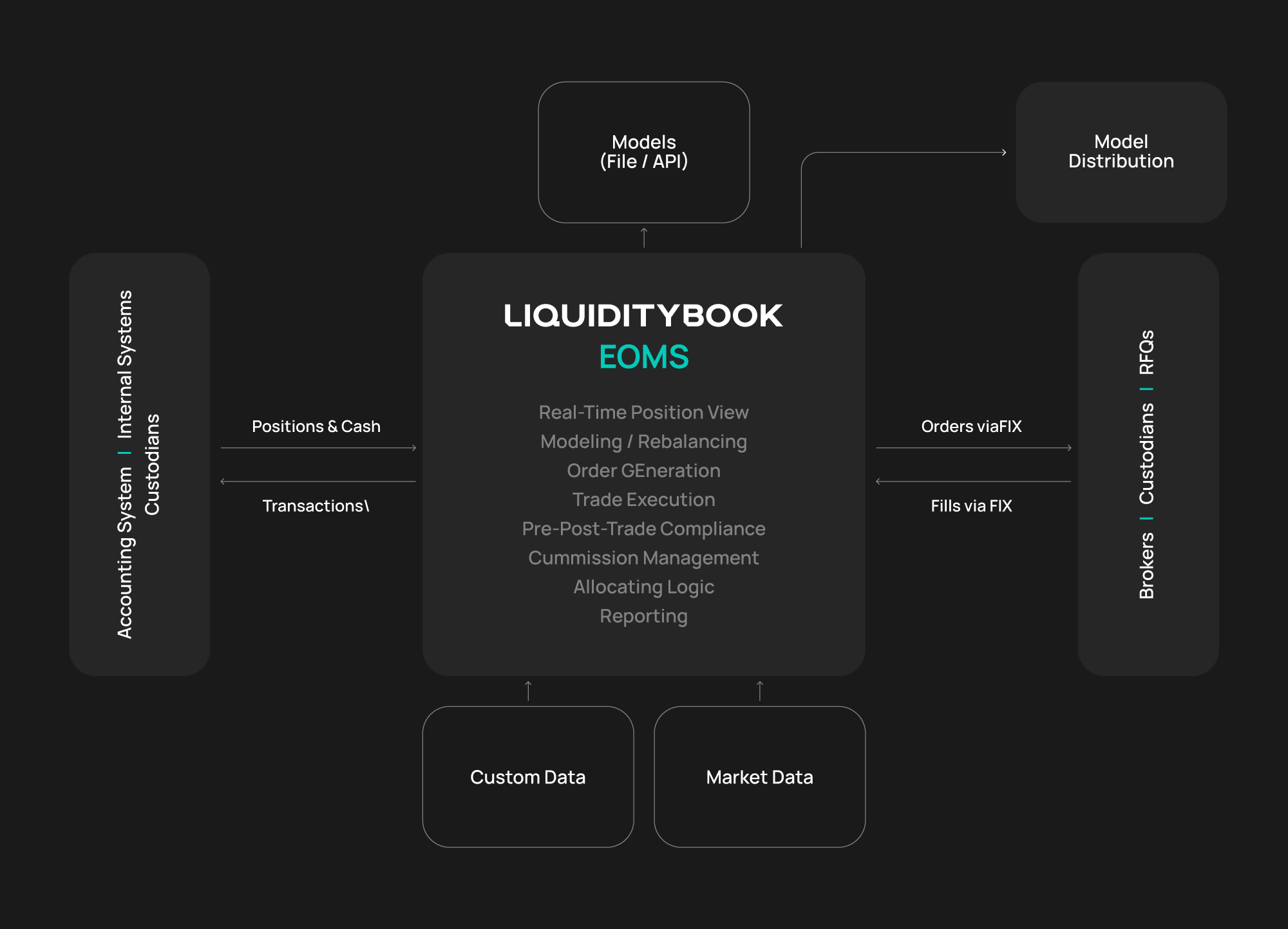

OEMS

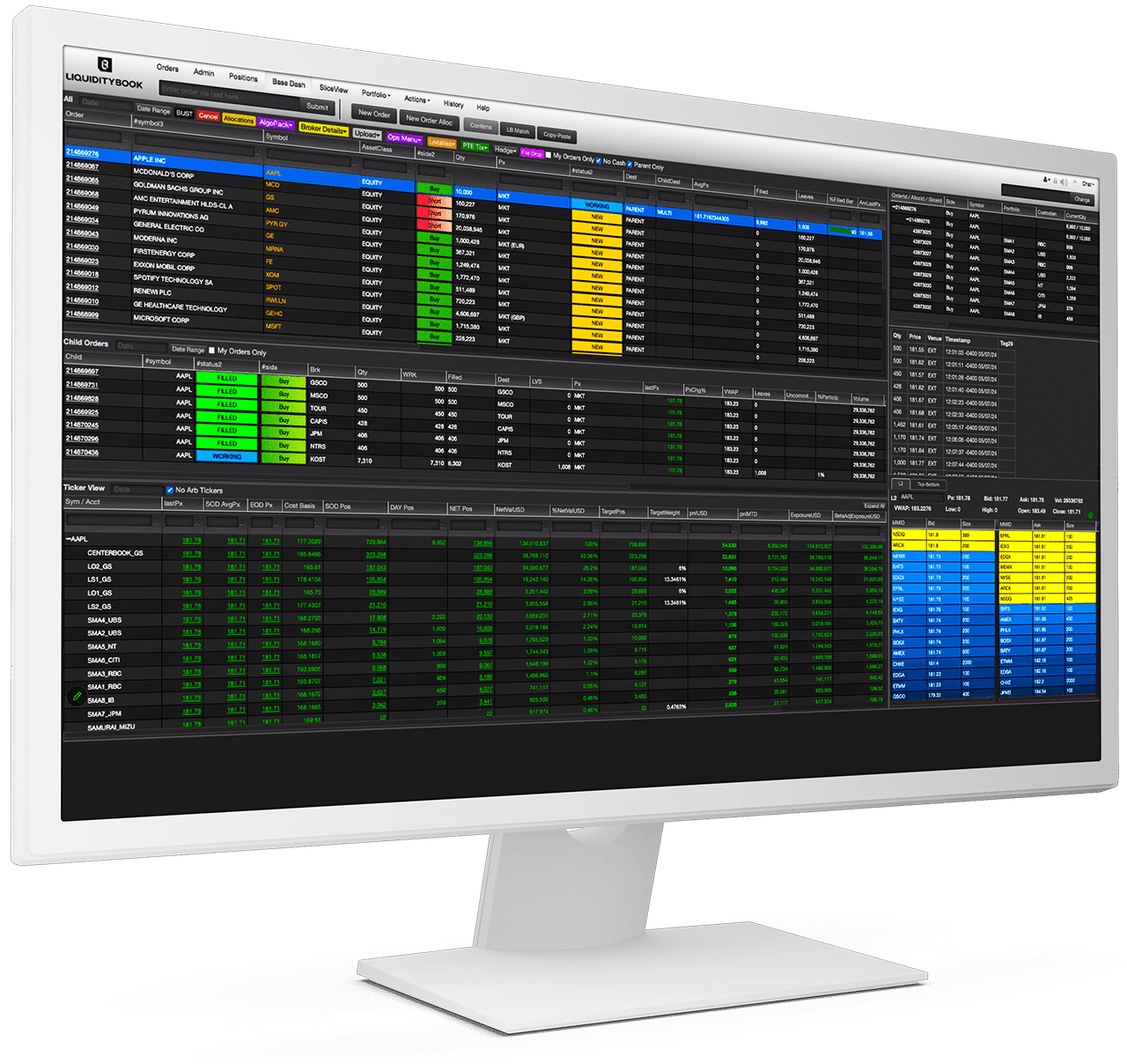

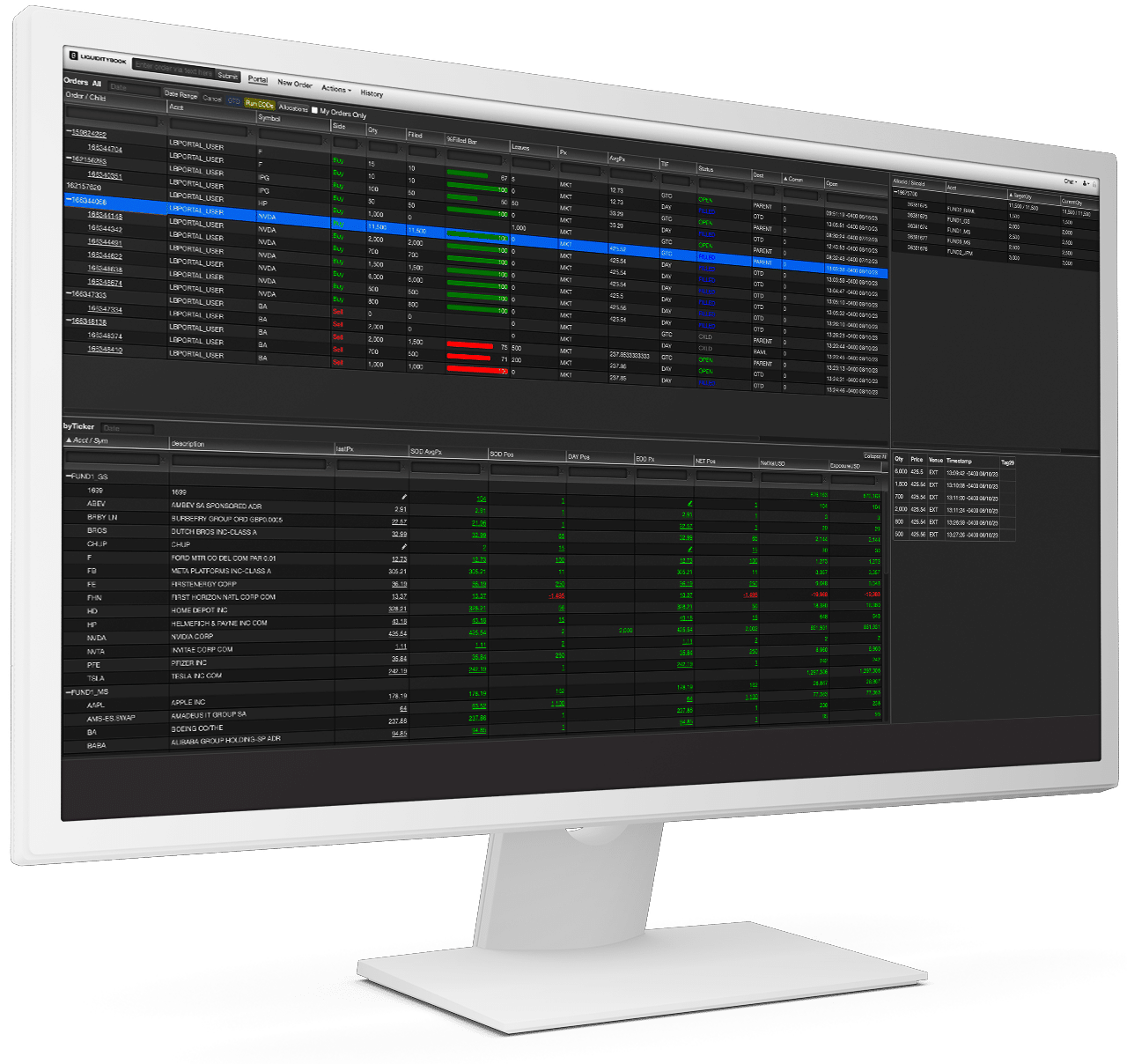

High-performance order and execution management built for efficiency, accuracy and automation

- Powerful FIX normalization to support inbound order flow from multiple sources, including IM/SMS, third-party systems, drop-copy and more

- Smart order routing and FIX connectivity with major custodians, brokers and liquidity venues

- Automatic order creation and execution based on portfolio model updates, client preferences and risk parameters

- Multi-asset coverage including equities, swaps, options, futures, fixed income, FX, interest rate derivatives, credit derivatives and mortgages

- Real-time position monitoring

- Top-to-bottom commission management, including custom rates by broker or client (or both)

- Robust API framework for out-of-the-box and bespoke integrations

- Support for multiple views, custom columns, hotkeys and real-time calculations

- Powerful stock locate capabilities

Portfolio and Model Management

Manage thousands of client accounts seamlessly with sophisticated model-based trading

- Real-time and historical P&L

- Flexible, efficient tools for creating, adjusting, applying and sharing custom models and model groupings

- Automatic portfolio rebalancing by any metric, capable of scaling updates across thousands of accounts in real time

- Tax-aware investing and robust compliance controls that account for client-specific mandates

- Robust cash management and allocation logic to meet liquidity requirements and investment strategies

- Position, trade and multi-counterparty reconciliation

- Shadow NAV calculation capabilities to fulfill reporting obligations

- Open workbench to perform functions on the fly

Compliance, Operations and Custodian Management

Simplify custodian connectivity, automate compliance and reduce operational risk

- Pre-built integrations with major custodians

- Automated trade file generation for standardized reporting and reduced manual work

- Pre-trade compliance checks with customizable parameters for individual traders and accounts

- Streamlined clearing and settlement for faster reconciliation

- Easy benchmark integration for model comparisons against the S&P 500, Russell 1000, etc.

An Array of Benefits

Comprehensive

A huge array of the POEMS capabilities and multi-asset trading tools that hedge funds and asset managers need most – all on a single platform.

Flexible

Seamless integration with all major vendors, primes, custodians and executing brokers. Employ multi-asset (including swaps) and multi-prime workflows.

Constantly Improving

Our modular multitenant platform means we can make daily product updates based on client requests with instantaneous delivery. All enhancements are delivered to the full user base.

Proven

For nearly 20 years, our trading and portfolio management solutions have empowered leading hedge funds and asset managers to take their investment and trading operations to the next level.

Focused

Cloud-based architecture means you pay for only the tools you want, not a bloated system you don’t need. LBX’s single codebase makes upgrading hassle-free, as all components can seamlessly communicate with one another.

Supportive

Support desks staffed by seasoned, onshore professionals paired with your business from Day One.

Client-Centric

Transparent, straightforward pricing that protects both sides of the Street.