SOLUTIONS / LBX CONNECT

A Proprietary Managed FIX Network and Gateway for Both Sides of the Street – And Their Partners

Award-Winning

Connectivity

LBX Connect is a core part of LBX Suite trading technology, enabling streamlined order routing, straightforward broker connectivity and access to over 1,600 routing destinations in more than 80 countries around the world. Available either fully integrated with your LBX implementation or as a standalone FIX normalization solution, LBX Connect offers the connectivity – and more – that banks, brokers, buy-sides and even vendors need.

FIX Hub

Connect seamlessly via our proprietary managed FIX network

- Connectivity to over 1,600 routing destinations and more than 200 brokers across 80+ countries around the world, with more added every quarter

- Robust FIX normalization to support incoming order flow from various upstream systems, different versions of FIX protocol, messages and tags, split messages and more

- Multi-asset coverage to connect to counterparties for equities, options, futures, fixed income and swaps trade execution

- Ability to write once to our spec and then access all brokers and destinations on the network

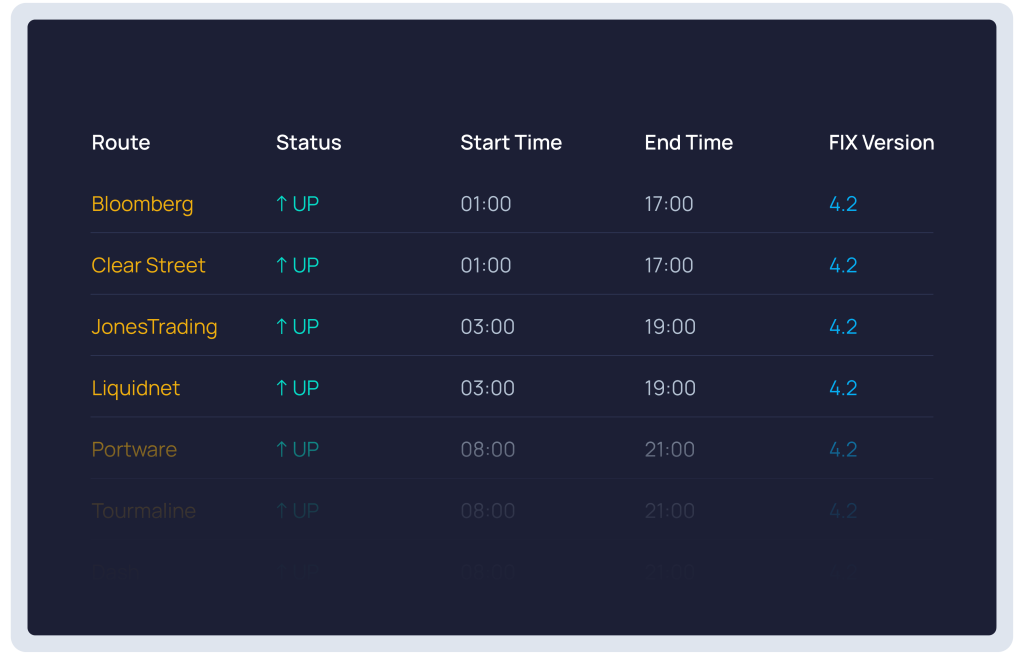

- Connection monitoring and order flow monitoring, so you can stay on top of your trading

- Capabilities beyond FIX: web blotter and backup/DR trading platform, Reg SHO order marking, risk/compliance checks, SOD/EOD files, trade automation and more

Connectivity to over 1,600 routing destinations and more than 200 brokers across 80+ countries around the world, with more added every quarter

Robust FIX normalization to support incoming order flow from various upstream systems, different versions of FIX protocol, messages and tags, split messages and more

Multi-asset coverage to connect to counterparties for equities, options, futures, fixed income and swaps trade execution

Ability to write once to our spec and then access all brokers and destinations on the network

Connection monitoring and order flow monitoring, so you can stay on top of your trading

Capabilities beyond FIX: web blotter and backup/DR trading platform, Reg SHO order marking, risk/compliance checks, SOD/EOD files, trade automation and more

LBX Risk Gateway

A compliance engine fit-to-purpose for the Sell Side

- Risk management tools support a range of clients (including retail, active trading and institutional clients) and pre-trade risk checks, including for away trades

- Aggregates order flow from multiple third-party OMS/EMS and across multiple clients, with support for custom rules by client

- Direct connection to LBX Connect, our managed FIX Network, for FIX normalization, streamlined integration and connectivity with existing partners, technology and workflows

- Supports SOD position load, SOD “easy to borrow” list, EOD trades, 15c3-5 reporting and more

- References custodian and intraday data to perform pre-trade checks

- Support for multiple asset classes

Risk management tools support a range of clients (including retail, active trading and institutional clients) and pre-trade risk checks, including for away trades

Aggregates order flow from multiple third-party OMS/EMS and across multiple clients, with support for custom rules by client

Direct connection to LBX Connect, our managed FIX Network, for FIX normalization, streamlined integration and connectivity with existing partners, technology and workflows

Supports SOD position load, SOD “easy to borrow” list, EOD trades, 15c3-5 reporting and more

References custodian and intraday data to perform pre-trade checks

Support for multiple asset classes