Solutions / lbx buy-side

Flexible Trading Technology for Hedge Fund Startups, Global Asset Managers and Everyone in Between

Intuitive workflows, expert support and instantaneous updates based on client requests mean more time to focus on what you do best: generating alpha.

Whatever your firm’s needs, we work with you to deliver a solution that seamlessly integrates the key components of the investment lifecycle and portfolio management, including connectivity to your trading counterparties. LBX Buy-Side is the industry’s leading portfolio, order and execution management system – available as either a full POEMS or with a focus on OEMS functionality – for hedge funds, asset managers and more, as well as a solution for regulatory compliance, FIX connectivity and a host of other mission-critical capabilities.

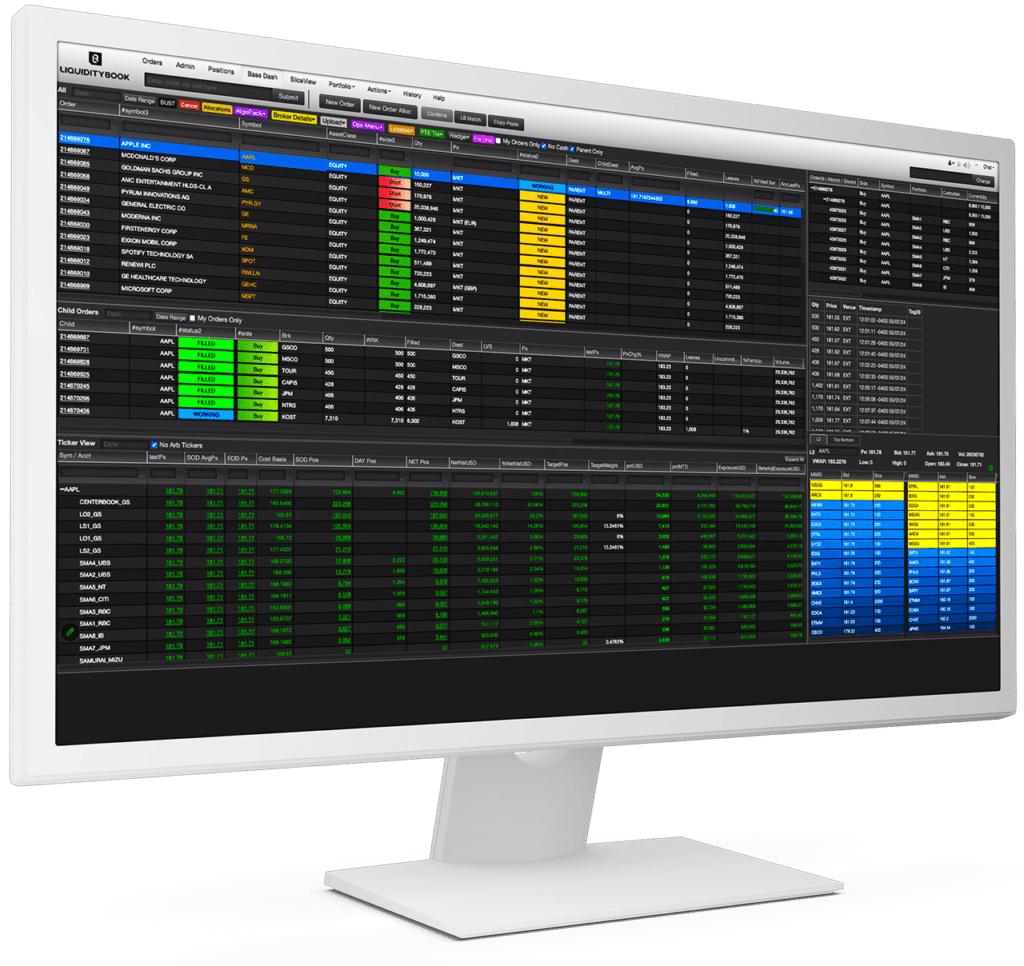

OEMS

OEMS

The Original Cloud-based Trading Platform

- Multi-asset coverage including equities, swaps, options, futures, fixed income, FX, interest rate derivatives, credit derivatives and mortgages

- Support for multiple views, custom columns, hotkeys and real-time calculations

- Bespoke allocation schemes and dynamic portfolio rebalancing/modeling tools

- Flexible order entry (including via IM and SMS) and robust order marking/linking

- Powerful stock locate capabilities

- Extensive automation support via advanced API protocols and FIX drop copies

- Seamless integration with prime brokers and clearing firms

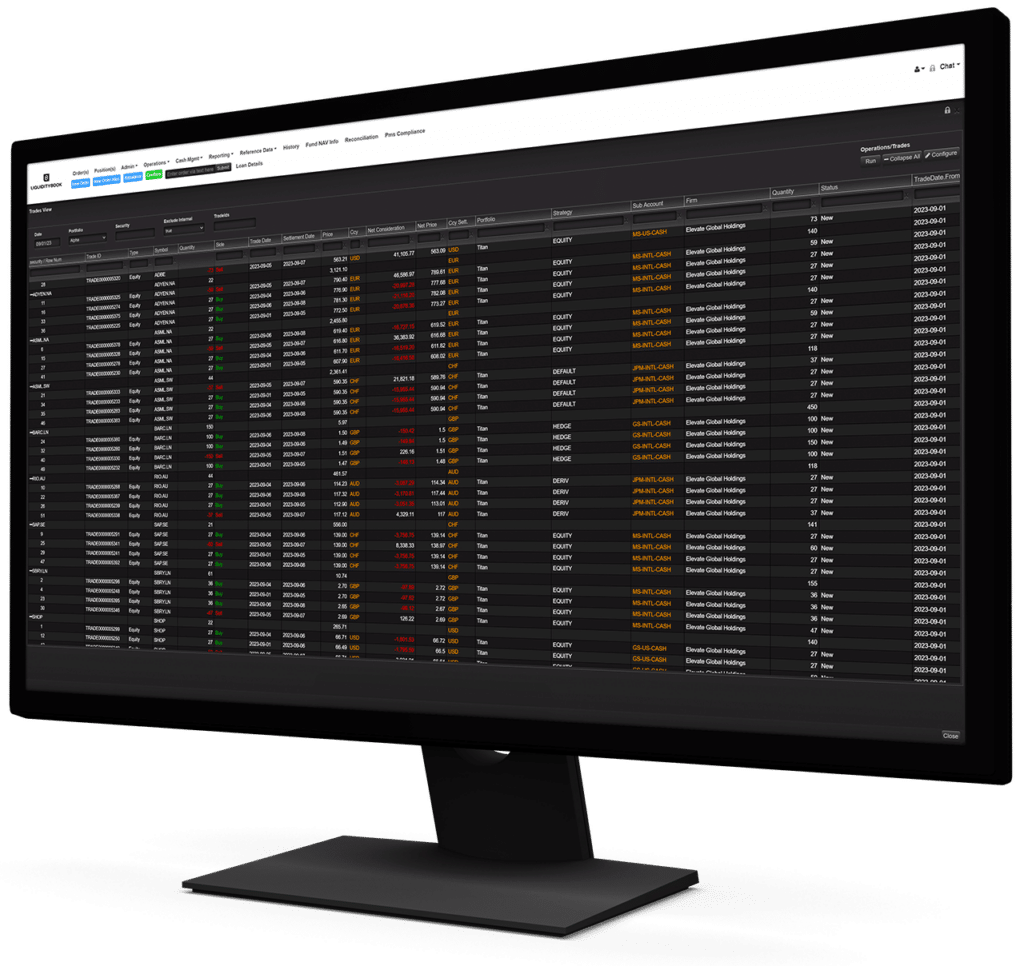

POEMS

POEMS

All-in-one Trading and Portfolio Management Technology

- All OEMS functionality

- Multi-asset and multi-prime workflows

- Advanced, user-driven reconciliation capabilities (including tri-party)

- Flexible tools to revise weights, create custom models and groupings and rebalance by any metric, including exposure, basis points and notional value

- Shadow NAV, accrual tracking and real-time and historical P&L

- Extensive bookkeeping and accounting capabilities

Launch Smarter with a Modern OEMS

Starting a hedge fund? LiquidityBook gives you the flexible, cost-efficient trading and operations platform you need to hit the ground running. From day one.

Learn how First New York transformed its portfolio, order and execution management workflows with LBX Buy-Side.