SOLUTIONS / LBX OMS

The Order Management System of Tomorrow. Today.

Software Capabilities

is within your reach.

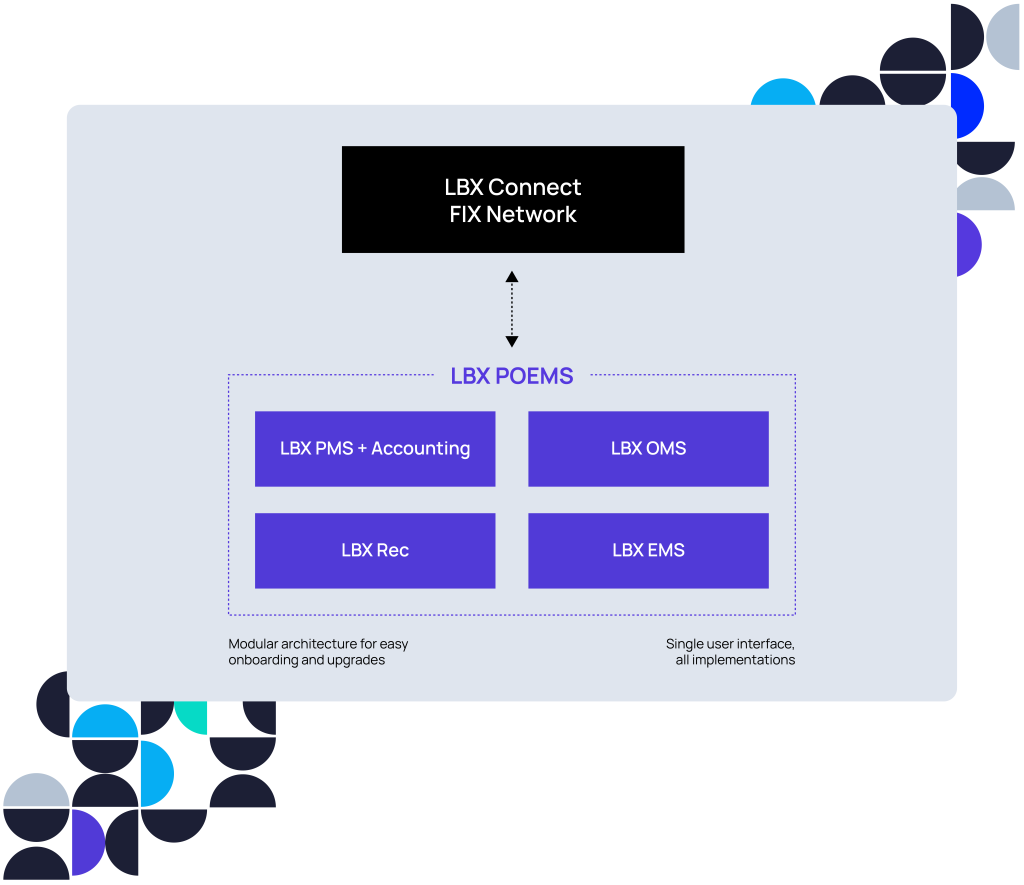

Our order management capabilities – part of LBX, our modular, cloud- and API-based POEMS – offers a wide range of capabilities to maximize portfolio performance, helping hedge funds, global asset managers and sell-side firms to stay competitive.

Move Faster. Perform Better.

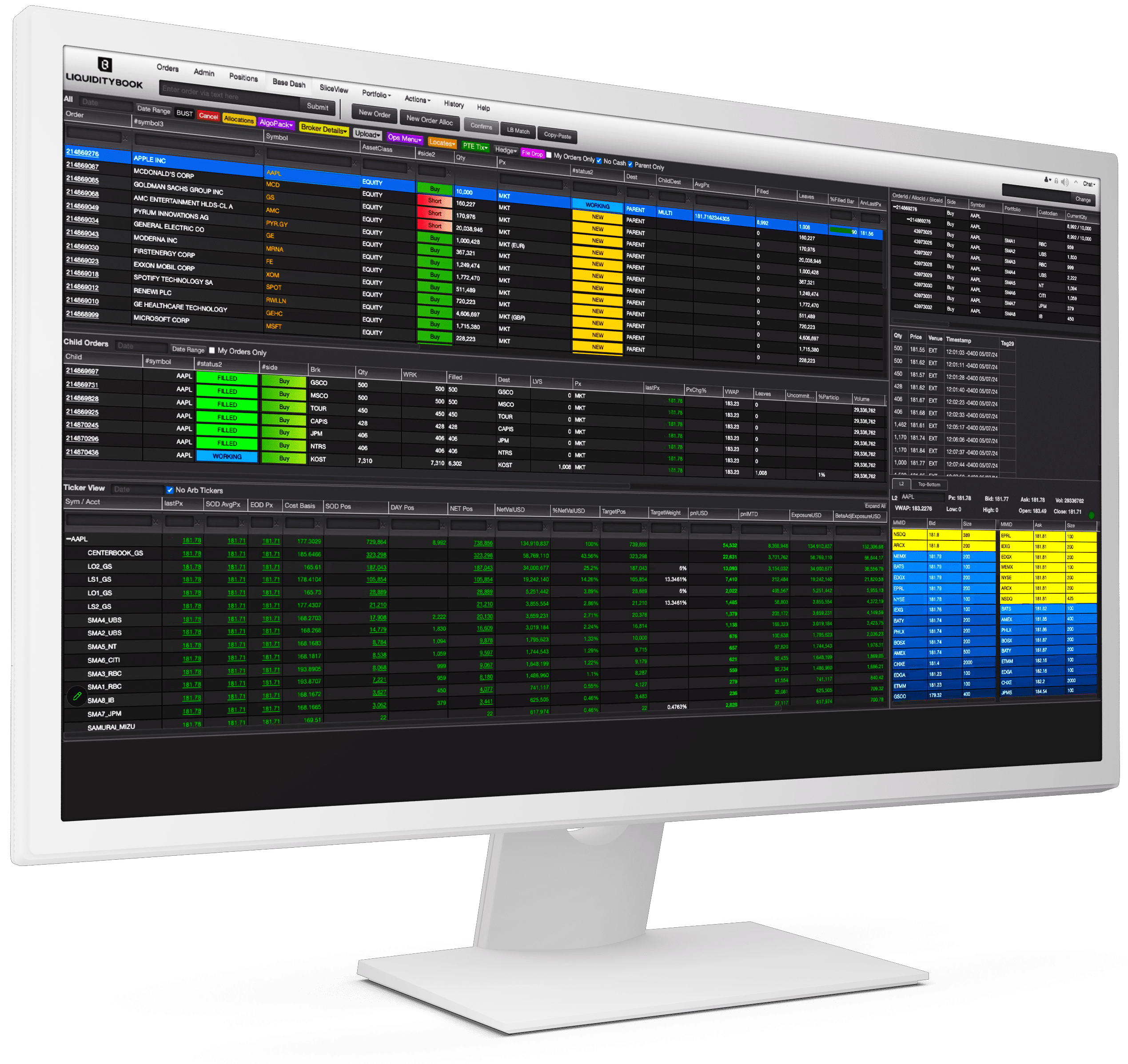

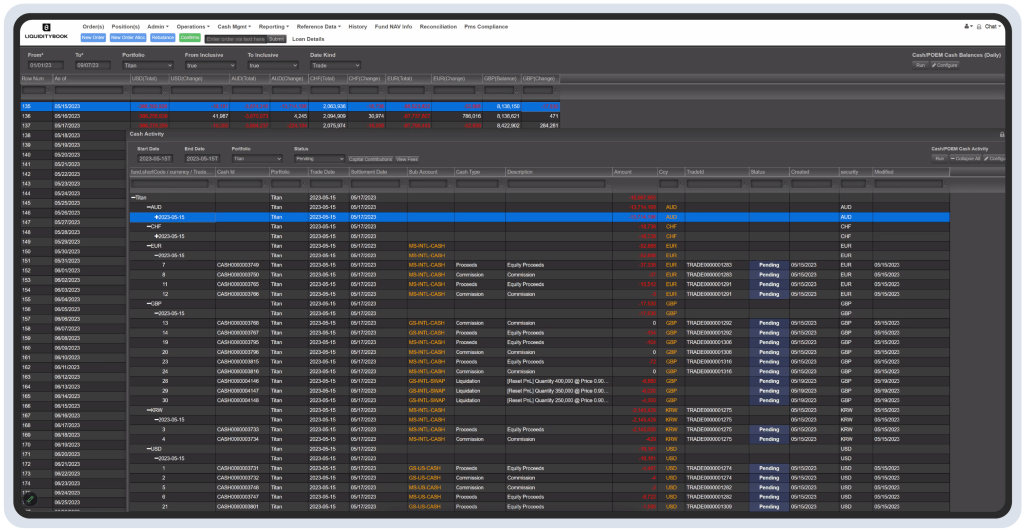

LBX OMS delivers flexible and easy-to-use order management capabilities for the modern trading firm. Manage positions and allocations, stage orders and tickets, locate inventory and track transactions from start to finish.

Robust Trading Functionality:

Bespoke allocation schemes, powerful stock locate capabilities and dynamic rebalancing/modeling tools

User-Friendly Workflows:

Customizable order blotter for real-time calculations, hotkeys for position sizing and linkable orders for allocation

Comprehensive Compiance/Reporting:

Pre-trade risk management parameters, out-of-the-box reporting capabilities and an array of avenues to assess performance

Flexible Technology:

Seamless integration with prime brokerage and clearing firms, automated operations via advanced API protocols and powerful messaging scraping capabilities

One Code Base. Every Use Case.

Our cloud-based, API-driven platform doesn’t just enable rapid product enhancements. It means we can configure your OMS for any use case – no matter who you are or where you sit.

Buy Side:

Intuitive workflows, powerful trading tools and expert support that enable you to do what you do best: generating alpha

Sell Side:

Efficient, economical capabilities to maintain performance amid shrinking margins, increasing regulation and continued fragmentation of execution venues

Outsourced Trading:

The precise functionality you need for your unique market position, so you can think like the buy side and execute like the sell side

Trading, Flexibility, Support

Our OMS is more than just an OMS – it’s your ticket to an advanced technology solution and a supportive partner that is deeply committed to your success.

- Full suite of newly enhanced, JSON-centric APIs enables the integration of myriad functions from across the trade lifecycle

- Modular, multi-tenant platform enables daily product updates based on client requests with instantaneous delivery, with all enhancements delivered to full user base

- Support desks staffed by seasoned, onshore professionals who are paired with you from the start and know your business inside and out

Efficiency By the Numbers

Facts & Figures

90

Markets Supported Globally

30+

Integrated Primes & Clearing Brokers

200+

Active Clients Globally

1,600+

Routing Destinations

Extensive Asset Class Coverage

- Equities

- Swaps

- Options

- Futures

- Fixed Income

- Interest Rate Derivatives

- Credit Derivatives

- FX

- Mortgages

“LiquidityBook offers a comprehensive platform. Not only do the OMS functionality and the compliance system work seamlessly together, but also the customized reporting and reconciliation tools provide our firm an all-in-one solution.”

Jim Eckhert,

Partner, President and COO, Tremblant Capital

Request a Demo

Take a modern approach to your trading with LBX OMS. Ready to learn more? Fill out this form and we’ll be in touch.